If you are struggling to pay your Council Tax bill, you should use MyAccount to contact with us as soon as you can, and we will try to help.

Council Tax arrears

If you fall behind with your Council Tax payments, we will send you a reminder letter or text.

First reminder

Your first reminder will give you seven days to bring your payments up to date. If you don’t bring them up to date, you will no longer be able to pay your bill by instalments and we can demand full payment of the rest of your Council Tax.

Second reminder

If you have previously received a reminder and brought your account up to date but are late paying again, we will send you another reminder. We will give you a further seven days to bring your Council Tax payments up to date.

If you bring your account up to date and pay all future instalments as detailed on your bill, we won't take any further action.

Final notice

You will receive a final notice if you miss a third consecutive instalment after you have paid the instalments requested by your first and second reminders. If you receive a final notice, you will lose the right to pay in instalments and will need to pay your Council Tax balance in full.

Issuing a summons

If you don’t bring your payments up to date, we will issue a summons through the magistrates’ court. This will increase the amount you owe us.

Once a summons is issued, £105 court costs are added to your account and the full balance including court fees is payable in full.

You can set up a special arrangement to pay off the balance within three months, but you will need to arrange this before the case is presented to the court. Failure to set up an arrangement or pay the balance in full will result in further recovery action being taken.

Attending court

Do not attend court in person, you will not be allowed into the building. The only way to attend a court hearing is by phone.

Please note, the following are not legal defences:

- I do not think I should have to pay

- I think the amount is incorrect

- I think I should get a reduction in my Council Tax

- I think my Council Tax reduction is incorrect

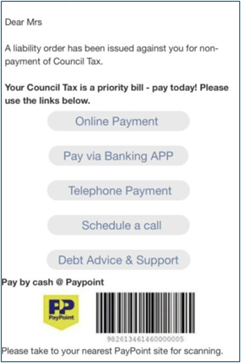

Liability order

If you do not pay the summons, including costs, we will ask the magistrates’ court to grant a liability order. This allows us to recover the amount owed using recovery actions, including:

- deductions from your benefits: Income Support, Job Seeker's Allowance, Employment Support Allowance or Pension Credit

- deductions direct from your salary, or your employer

- appointing enforcement agents to remove and sell your possessions (you will be liable to pay any additional fees)

- making you bankrupt in the county court (you will be liable to pay any additional fees which can be substantial)

- applying for a charging order at the county court so we can force the sale of your home (you will be liable to pay any additional fees)

- applying for a warrant of commitment to send you to prison for up to 90 days

Deducting your earnings

We can apply for something called an attachment of earnings order if you are employed by another person or company and are on a PAYE pay scheme.

An attachment of earnings order is a legal document that is sent to your employer which requires them to take money from your wage to clear your Council Tax debt. Your employer can also take an extra £1 for each deduction for their administration costs.

The amount taken from your wages will be a percentage of your income. This percentage can rise or fall depending on what you earn per month.

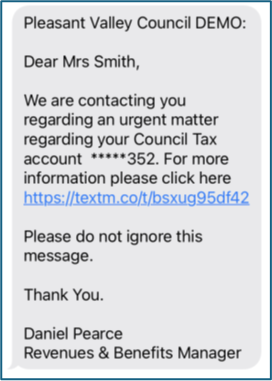

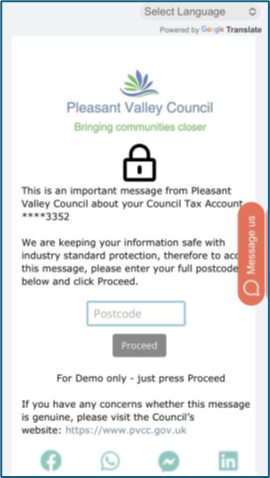

Text, email and voice messaging service

If your Council Tax account falls into arrears we may contact you using a text message, email reminder or voice message before taking further recovery action.

This service can prevent statutory recovery notices being issued and may help you avoid paying expensive costs. It provides the opportunity to act prior to any formal recovery proceedings commencing.

While this service is offered to prevent customers from falling further into arrears, it should not be relied upon. It is your responsibility to maintain the instalments due on your account in line with your bill. Failure to do so may result in recovery action being taken.

Emails and texts are not part of the legal Council Tax billing and recovery process. Please don't depend on them to remind you to pay.

If your device supports Rich Communication Services (RCS), you'll see that we are a verified sender, so you'll know the message is genuine. Links in our messages will always include 'n-somerset.gov.uk'.

We may contact you using one or more of the following:

- SMS message, with the title N-Somerset

- email from info.n-somerset.gov.uk

- voice calls from 01934 888144

If you're not sure if a message is from us, please contact us directly or log in to MyAccount to check your account.