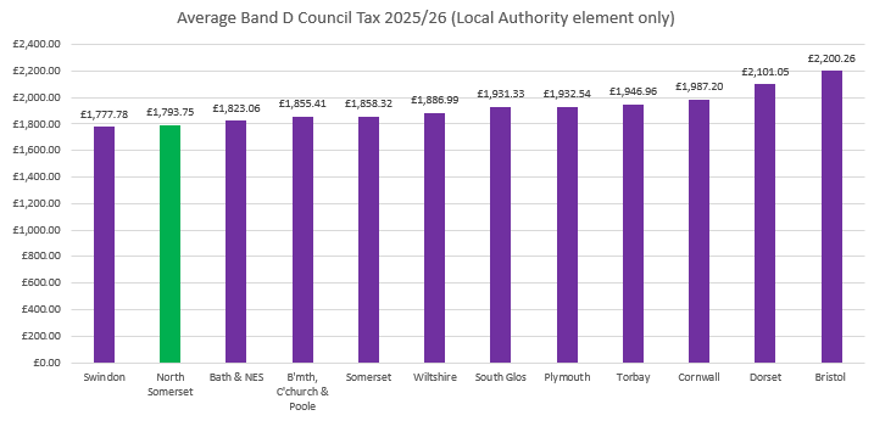

Council Tax in North Somerset remains lower than in most other areas in the South West. This is due to

- historically low annual Council Tax increases and;

- current rules that limit Council Tax increases to a maximum of 4.99% each year

Raising Council Tax beyond 4.99%

If a council wishes to raise Council Tax by more than 4.99% it must be agreed by referendum.